It might be difficult to believe, but the Fair Labor Standards Act (FLSA), which was the first law to really give U.S. workers any rights, was first signed into law in 1938 towards the end of the Great Depression under President Franklin Roosevelt’s administration. Not only did it set a standard work week and the nation’s first minimum wage of 25 cents per hour, but it also required employers to keep records on the hours worked by each employee so that employees who exceeded the standard work week would be paid overtime.

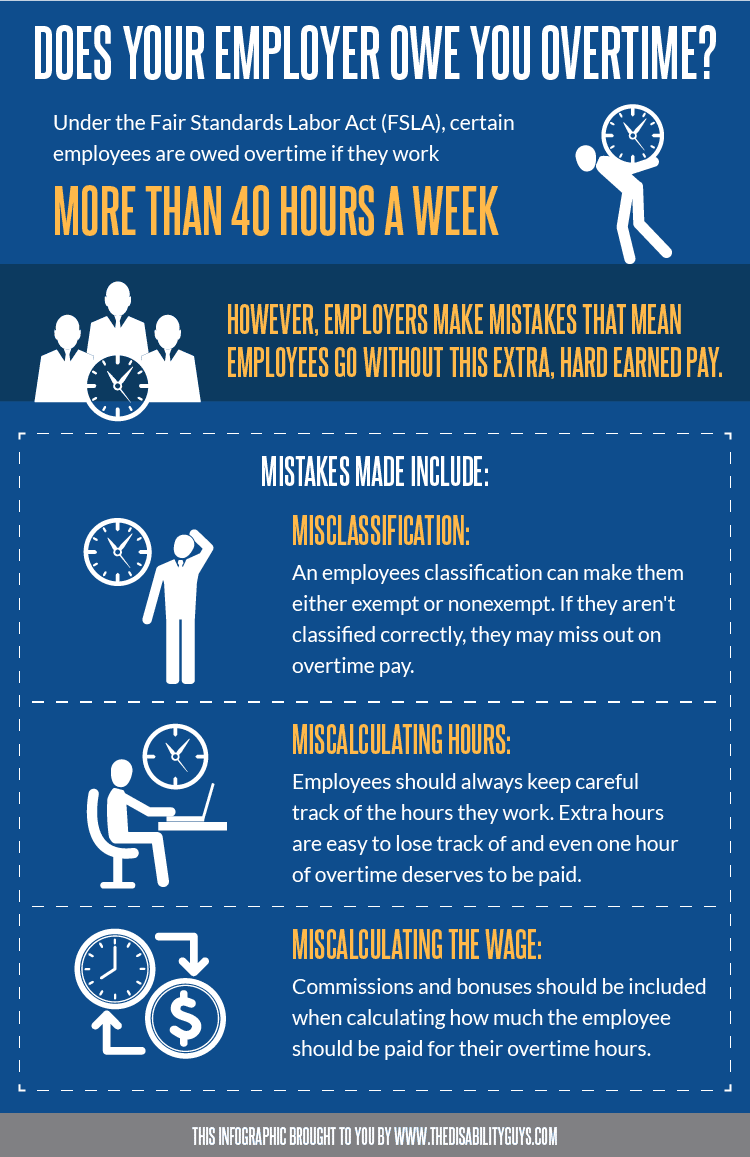

Under the FLSA, workers who work beyond the standard 40 hours must be paid at a rate of no less than one and one-half times their normal rate of pay.

Who Is Eligible To Receive Overtime Pay?

Unfortunately, not every employee is eligible for overtime pay. Those who aren’t are referred to as “exempt”. For the majority of employees, determining if overtime is available for them depends on:

Unfortunately, not every employee is eligible for overtime pay. Those who aren’t are referred to as “exempt”. For the majority of employees, determining if overtime is available for them depends on:

- How much money an employee makes.

- How the employee is paid.

- What type of work the employee performs.

The best way to determine if you are eligible for overtime pay is to contact an experienced attorney who can review your job history. That being said, if you are nonexempt and your employer hasn’t been paying overtime, you may be able to take legal action.

Share this Image On Your Site

Common Overtime Violations Made By Employers

While some employers willfully make mistakes or change records to avoid paying their employees their hard earned overtime, other genuinely make mistakes. Common mistakes include:

Misclassification

Employee classification matters. If an employee is misclassified, it can impact their ability to collect overtime. Common violations include:

- Calling an employee a “manager” even though their duties are the same as employees are they are supposed to be supervising.

- Indicating that an employee is exempt because they are under a white collar exemption even though their job doesn’t require discretion and independent judgement.

- Paying an employee based on the hours they work each week instead of a “true” salary that doesn’t change.

- Docking an employee’s pay for reasons that are not allowed, such as performance and productivity.

Improperly Counting Hours

It’s not uncommon for employees to feel pressure from their employers to work longer and harder. But under the law, employers must pay for any extra work even if the employee works:

- “Off the clock” – before and after they “officially” clock in and out.

- Through their lunch period.

- Extra time at home.

- While traveling (for work).

In addition to this, the employer must include time spent while putting on or taking off protective gear and time spent training.

Miscalculating The Wage

It might seem easy to calculate overtime – it should be 150% of the employee’s regular hourly wages. But that compensation can include:

- Commissions and shift differentials.

- Performance based bonuses and prizes.

What Should I Do If I Suspect I Am Owed Overtime Wages?

If you believe that you are owed overtime pay, the first thing to do is collect all documentation regarding the hours that you believe you have not been compensated for. Then, you can start by talking to your employer to see if it was just a simple oversight and they are willing to address the matter.

If you can’t make headway with your employer then it’s best to contact an attorney who can explain the process of filing a claim and begin the process of filing a lawsuit.

What Can Be Gained From Filing An Overtime Lawsuit?

When a plaintiff is awarded compensation it is known as “damages”. In overtime lawsuit cases, the damages that a plaintiff may be able to recover include:

Unpaid Wages

Of course, the unpaid wages that are owed should be part of the damages obtained.

Interest

The plaintiff is entitled to obtain interest on any unpaid wages that they recover.

Penalties

This is essentially a penalty the employer will have to pay for forcing their employee to wait for their fair wages.

Attorney’s Fees

If the lawsuit is successful the employer will have to pay for the plaintiff’s attorney’s fees and the costs of pursuing the complaint.